Accord Financial Closes Sale of BondIt Media Capital

Toronto – February 10, 2026: Accord Financial Corp. (TSX – ACD) (“Accord” or the “Company”) today…

Fast A/R Financing from $500K to $2MM

Apply Now

For over 40 years, we have financed companies in

transition – reinventing, rebuilding, or simply shifting into

growth mode. With a full range of versatile solutions,

Accord holds the key to unlock our clients’ potential.

Whether you need to optimize your cash flow, spearhead a restructuring, or invest in the next phase of growth, we deliver flexible financing services to help your business thrive.

Accord’s financing solutions can help you transition to the next stage in your business.

Tackle growth-related challenges to achieve your goals

Secure a loan to finance your next acquisition or buyout

Propel your company’s recovery with proper financing

Improve receivables turnover and manage bad debt loss

Unexpected events can happen anywhere and anytime

Every industry faces its own set of challenges, and every business has its own unique path to success. With over 40 years of experience, Accord has the expertise to navigate to a competitive advantage; to not only survive, but ultimately to thrive.

Accelerate cash flow to gear up for growth

Leverage your inventory to keep cash flowing

Capitalize when growth opportunities arise

Use our financing for your customers’ financing

Focus on your core business of buying or selling abroad

Get working capital and equipment financing for growth

Win financing to invest in cash-generating assets

Get fast access to funding to keep inventory flowing

Increase liquidity to keep suppliers and customers loyal

Toronto – February 10, 2026: Accord Financial Corp. (TSX – ACD) (“Accord” or the “Company”) today…

Running a business rarely feels predictable. Cash comes in on different timelines. Expenses show up before…

Accord Financial Corp. (“Accord” or the “Company”) (TSX – ACD) today announced that holders of the…

Pursuant to the amendment, the total commitment under the Bank Facility will be reduced from $205…

Refinancing Plan: As part of a comprehensive refinancing plan the Company also announced that it will…

1. Traditional Bank Loans Size / Stage Structure Best Scenario 2. Asset-Based Lending (ABL) Size /…

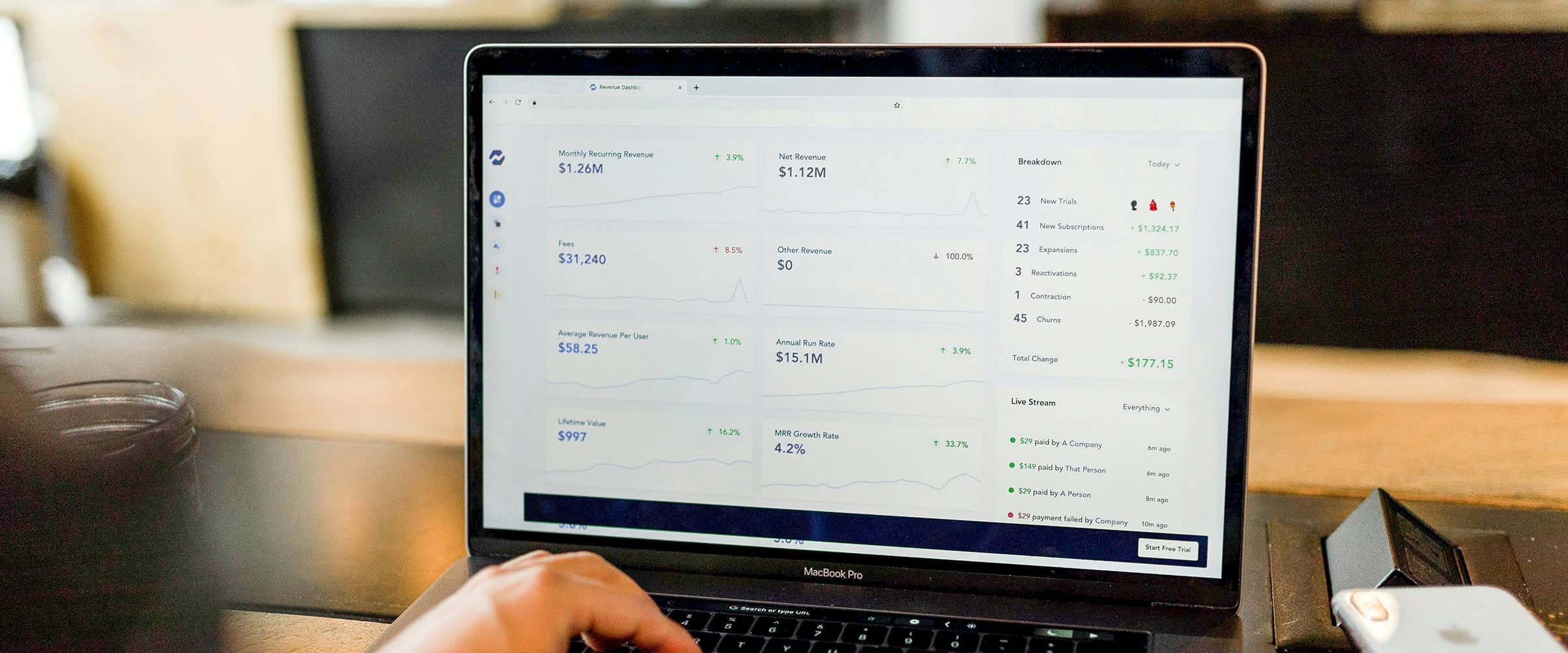

Summary of Financial Results Three Months Ended Sept 30 2025 2024 $ $ Average funds employed…

Understanding Invoice Factoring Invoice factoring allows businesses to sell unpaid invoices in exchange for immediate working…

Summary of Financial Results Three Months Ended June 30 2025 2024 $ $ Average funds employed…

Why DIP Financing? When a business files for bankruptcy protection under the Canadian Bankruptcy & Insolvency…

Shareholders voted in favour of all items of business put forth at the meeting as set…

Borrow Right with These 5 Tips A Business Line of Credit is a tool – Use…

What We Don’t Talk About Enough Equipment financing is not just for when budgets are tight….

The Power of Opportunity In today’s fast-paced market, businesses need to be agile, constantly adapting and…

Summary of Financial Results Three Months Ended March 31 2025 2024 $ $ Average funds employed…

The Company confirms that it has completed the filing of its audited annual consolidated financial statements…

Accord Financial Corp. (TSX – ACD) today released its financial results for the fourth quarter and year ended December 31, 2024.

This increased facility will provide the working capital required to help the company meet rising demand,…

A Seat at the Table: Alicia Jackson’s Story of Empowerment and Leadership in Finance

Inspiring Growth: Kawaljulah Rockwell Reflects on Her Journey in Finance

Accord embraced the opportunity to step in as the senior lender, allowing the company to graduate…

Accord Financial Corp. (TSX – ACD) today released its financial results for the quarter ended September 30, 2024.

The Big Picture A/R Financing acts as a safety net for companies utilizing this strategy, providing…

Gross proceeds of the transaction are $63.2 million (US$46.8 million), which is expected to have a…

Toronto – August 8, 2024: Accord Financial Corp. (TSX – ACD) today released its financial results for the quarter ended June 30, 2024.

Banking on the Banks? Applying for a bank loan seems like the easy first choice, after…

The Company does not consider the additional disclosures to be material but recognizes that the original…

Cost of Convenience Nothing is as good as it seems, including business loan terms. When there…

In Canada, the Company announced the successful closing of a private securitization facility agented by a…

What does a Business Line of Credit Offer? This type of loan is so customary in…

Accord Financial Corp. (TSX – ACD) (the “Company”) today announced the voting results from its Annual Meeting of Shareholders (“AGM”) held on May 14, 2024 in Toronto, Ontario.

Accord Financial Corp. (TSX – ACD) today released its financial results for the quarter ended March 31, 2024.

A study by Deloitte helps illustrate just how significant this disadvantage can be: companies with revenues…

What started as an equipment finance opportunity quickly developed into a more substantial transaction with the…

Join us as we delve into the realities of leadership and the ongoing pursuit of inclusivity and empowerment in the finance industry with JoAnne.

Accord Financial Corp. (“Accord” or the “Company”) (TSX – ACD) today released its financial results for the fourth quarter and year ended December 31, 2023.

What is your job description/ what do you do for Accord? My title is VP Credit…

In 2021, Accord Financial provided a $13 million facility for Energetic Services Inc. (Energetic), an oil and gas services company, solidifying its commitment to supporting businesses during both recovery and expansion phases.

Welcome to the world of AccordExpress Factoring – where speed meets flexibility, and your business can thrive!

Invoice factoring is a form of financing that businesses can use to improve their cash flow. When businesses factor invoices, they sell them to a factoring company at a discount in exchange for immediate payment. This allows businesses to get access the money they’re owed right away, rather than waiting for their customers to pay.

Accord Financial Corp., one of the U.S. and Canada’s leading independent commercial finance companies (“Accord”) (TSX: ACD) announced the hiring of Ryan Ray, an experienced asset-based lending (ABL) and equipment professional to the Accord Financial team.

Most growing companies should have a revolving facility in place because it enables additional growth in operations and limits the potential issue of growing faster than liquid capital. This was certainly true for Accord’s newest client, a well-established contractor in Western Canada.

Accord Financial Corp. (“Accord” or the “Company”) (TSX – ACD) today released its financial results for the third quarter ended September 30, 2023. The financial figures presented in this release are reported in Canadian dollars and have been prepared in accordance with International Financial Reporting Standards.

Asset-based lending refers to a specific type of secured loan that leverages company assets as collateral. An asset-based loan can help established companies grow by using their assets as collateral for business financing.

Accord Financial announces the closing of a $40MM equipment lease line to a leading pet supply manufacturer and distributor. This financing has enabled the company to purchase new mission-critical equipment for its primary manufacturing plant as it expands its production capacity and sales.

The outbreak of the global pandemic had drastic effects on the economy, leading to job losses and business closures. In order to support those who had lost their jobs and businesses, the federal governments of Canada and the United States injected a significant amount of money into the economy in the form of subsidy packages and loans.

With over two decades in small business lending, I’ve had the privilege of witnessing the ebbs and flows, triumphs, and challenges of countless businesses. These experiences have cemented my understanding of the integral role financing plays in the success of every small enterprise.

Accord Financial Corp. (“Accord” or the “Company”) (TSX – ACD) announced the following amendments (the “Amendments”) to its 7% convertible unsecured subordinated debentures issued on December 18, 2018 and due December 31, 2023 (the “Debentures”) are effective today:

Accord Financial Corp. (“Accord” or the “Company”) (TSX – ACD) today released its financial results for the second quarter ended June 30, 2023.

Accord Financial Corp. (TSX – ACD) today announced that its Board of Directors has declared a quarterly dividend of $0.075 per share, payable September 1, 2023, to shareholders of record at the close of business August 15, 2023.

Across industries, companies are always looking for ways to make sure they have enough working capital. Whether to seize growth opportunities or to overcome unforeseen challenges, businesses can acquire working capital by selling their accounts receivables to a factoring company; another way is by leveraging their unpaid invoices for a loan. Both of these methods allow businesses to get fast access to funds and are alternatives to a traditional bank loan.

Accord Financial Corp. (TSX – ACD) (“Accord” or the “Company”) today announced the mailing of an information circular and related meeting materials (the “Meeting Materials”) in connection with the previously announced upcoming special meeting of the holders (the “Debentureholders”) of its 7% convertible unsecured subordinated debentures due December 31, 2023 (the “Debentures”) to be held at 5300 Commerce Court West, 199 Bay St., Toronto, ON M5L 1B9 on August 10, 2023 at 10:00 a.m. (Eastern Daylight Time) (the “Meeting”).

Accord Financial Corp. (“Accord”) today announced the launch of Accord | EDC Trade Expansion Lending Program (“Accord | EDC TELP”), the Company’s latest financing innovation supported by Export Development Canada (EDC). Accord | EDC TELP builds on Accord’s success in tailoring EDC programs specifically for the Canadian small business sector. Accord is the first non-bank, or non-credit union, financial institution to partner with EDC in directly financing Canadian SMEs with TELP.

Accord Financial Corp. (TSX – ACD) (“Accord” or the “Company”) today announced that it will seek the approval of the holders (the “Debentureholders”) of its 7% convertible unsecured subordinated debentures due December 31, 2023 (the “Debentures”) to amend certain terms of such Debentures at a special meeting of the Debentureholders to be held at 5300 Commerce Court West, 199 Bay St., Toronto, ON M5L 1B9 on August 10 at 10:00 a.m. (Eastern Daylight Time) (the “Meeting”).

Accord Financial Corp. (TSX – ACD) (the “Company”) today announced the voting results from its Annual Meeting of Shareholders (“AGM”) held on May 25, 2023 in Toronto, Ontario. Shareholders voted in favour of all items of business put forth at the meeting.

Businesses of all sizes need healthy cash flow to thrive, and there are many options when it comes to securing the capital they need. For some businesses, the best route is to use traditional bank lending, and for others, using independent asset-based lenders is the optimal choice.

Reshoring manufacturing is a hot topic these days, as the cascading effects of supply chain disruptions are still being felt throughout the economy.

Accord Financial Corp. (TSX – ACD) today released its financial results for the quarter ended March 31, 2023. The financial figures presented in this release are reported in Canadian dollars and have been prepared in accordance with International Financial Reporting Standards.

Accord Financial Corp., one of the U.S. and Canada’s leading independent commercial finance companies (“Accord”) (TSX: ACD) has added to its U.S. business development team with the hiring of Ira Almond as Director of Business Development, US Asset Based Finance, Southeast and Sahil Sharma as Director of Business Development, US Equipment Finance, Northeast.

Accord Financial Corp. (TSX – ACD) today announced that its Board of Directors has declared a quarterly dividend of $0.075 per share, payable June 1, 2023, to shareholders of record at the close of business May 15, 2023.

Accord Financial Corp., one of North America’s leading independent commercial finance companies (“Accord”) (TSX: ACD) is now offering Canadian companies a new, fast, and convenient way to obtain accounts receivables financing through the AccordExpress Factoring Portal.

Accord Financial Corp., one of the U.S. and Canada’s leading independent finance companies (“Accord”) (TSX: ACD), is pleased to announce the closing of a $2.5 million credit facility to help a marine services company move into the wind energy space. Accord’s Asset Based Lending Group structured the facility to include a traditional revolving credit package backed by accounts receivable.

Small and medium-sized businesses are the backbone of our economy, so it’s important to have financial options to better support them. For companies in a rapid growth phase, quick and flexible funding is essential, and accounts receivable factoring can be an optimal financing solution.

When a travel company’s business picked up dramatically post-Covid, Accord Financial Corp., one of North America’s leading independent commercial finance companies (“Accord”) (TSX: ACD) moved quickly to provide the company with the liquidity they needed to manage their fast-growing business. As one of the hardest hit industries, travel had come to an almost complete halt during Covid. The company’s operating lender cut their line of credit to twenty percent of the amount authorized. When travel picked up in 2022, the original banking lender couldn’t restore the company’s higher limit.

Business owners don’t always understand what it means when they receive a Forbearance Letter from their financial institution. This article outlines why these letters are received, what they mean, what you should expect if you received one, and what actions you should take.

Accord Financial Corp. (TSX – ACD) today released its financial results for the fourth quarter and year ended December 31, 2022. The financial figures presented in this release are reported in Canadian dollars and have been prepared in accordance with International Financial Reporting Standards.

Businesses have a wide array of expenses. Paying their bills on time, investing in their business growth, and even delivering employees’ salaries on time can be difficult for businesses that rely heavily on customer invoicing to meet their financial obligations on time. An accounts receivable factoring company may be able to help businesses protect their cash flow and working capital with a financing solution known as invoice factoring.

Accord Financial Corp., one of North America’s leading independent commercial finance companies (“Accord”) (TSX: ACD) moved quickly to help a leading child safety product manufacturer when the company’s previous lender decided to reduce its footprint in the Canadian market. Over the past several years, the company had resolved their supply chain problems by acquiring a contract manufacturer that had been making their products. When the company’s original lender pulled out, Accord was able to quickly grant a higher asset based operating line. This extra financing will give the company the funds they need to further consolidate their manufacturing processes as well as provide room for growth.

Accord Financial Corp. (TSX: ACD) today announced that its Board of Directors has declared a quarterly dividend of $0.075 per share, payable March 1, 2023, to shareholders of record at the close of business February 15, 2023.

Accord Financial Corp., one of the U.S. and Canada’s leading independent finance companies (“Accord”) (TSX: ACD) announced the closing of a $13 million credit facility to support the acquisition of an equipment services company. Accord’s Asset Based Lending Group structured the facility to include a traditional revolving credit package backed by accounts receivable and inventory as well as a term loan supported by equipment.

How do you work with our clients throughout their time with Accord? I work with clients…

Accord Financial Corp., one of the U.S. and Canada’s leading independent commercial finance companies (“Accord”) (TSX: ACD) announced a realignment plan to better support the organization’s continued growth among middle market businesses, uniting all U.S. commercial financing programs under one umbrella.

What exactly is your involvement as Director of Marketing for Accord? “While a lot of what…

Summary of Financial Results While navigating a challenging business environment, the Company’s third quarter performance reflected…

“We are excited to have such a proven, successful finance professional join our Accord team,” stated…

Accord Financial Corp., one of the U.S. and Canada’s leading independent commercial finance companies (“Accord”) (TSX: ACD) is pleased to announce the promotion of Irene Eddy as its Chief Financial Officer effective October 1, 2022. As CFO, Eddy will lead Accord’s finance organization, responsible for providing strategic and operational leadership and supporting business unit leaders in all areas of finance, capital, reporting and strategy.

Approaching the 4th year of the pandemic, Canadian businesses are struggling to secure not only enough employees but the right ones. HR departments and head-hunters are struggling to hire and retain employees for a number of reasons.

When a company is owned and run by two or more entities, they establish a legal relationship by becoming business partners, sharing in the profits of the business. There are many different types of partnership agreement, and most partnerships will include provisions that spell out partnership buyout agreements. Think of these as corporate prenups.

Accord Financial Corp. (TSX – ACD) today released its financial results for the three and six months ended June 30, 2022. The financial figures presented in this release are reported in Canadian dollars and have been prepared in accordance with International Financial Reporting Standards.

A growing business needs capital to expand. However, as small business owners nationwide know very well, sometimes getting access to that capital isn’t always easy to do, and using existing revenues or savings is not always ideal. Many businesses require specialty equipment, and when expanding, they will need to purchase equipment to grow. This is where equipment financing can help.

Beginning in junior roles in finance and working tirelessly to achieve her current position, Tara’s keen insight into the psychology of people and business guides her passion for creating a positive impact in the industry.

Accord Financial Corp. (TSX: ACD), one of the U.S. and Canada’s leading independent commercial finance companies has expanded their US Asset Based Finance group to include Gail Heldke and Maryanne Lenardo. Both with the title of Managing Director, Originations, each will be responsible for developing partnerships across a broad range of industries providing senior secured debt solutions ranging from $1MM to $20MM. Maryanne will be based in Los Angeles covering the western US, while Gail will be based in Chicago and cover the Midwestern US.

How To Craft Business Plans That Increase Your Chance of Success If you are a small business owner in need of funding, your business plan could mean the difference between success and failure when applying for small business loans.

Accord Financial Corp., one of the U.S. and Canada’s leading independent commercial finance companies (“Accord”) (TSX: ACD) announced the appointment of Irene Eddy as interim CFO effective June 15, 2022 alongside the departure of Stuart Adair, the company’s long-time CFO.

Accord Financial Corp. (TSX – ACD) (the “Company”) today announced the voting results from its Annual Meeting of Shareholders (“AGM”) held on May 4, 2022 in Toronto, Ontario. Shareholders voted in favour of all items of business put forth at the meeting.

Accord Financial Corp. (TSX – ACD) today released its financial results for the quarter ended March 31, 2022. The financial figures presented in this release are reported in Canadian dollars and have been prepared in accordance with International Financial Reporting Standards.

Accord Financial Corp. (TSX – ACD) today announced that its Board of Directors has declared a quarterly dividend of $0.075 per common share, payable June 1, 2022, to shareholders of record at the close of business May 13, 2022.

As a member of the executive leadership team, Cathy Osborne leads all human resources functions across the entire Accord Financial organization, developing a unified culture between the firm’s six operating units. Behind the scenes, Cathy makes Accord’s workplace enjoyable, diverse, and engaged.

Accord Financial Corp., one of the U.S. and Canada’s leading independent finance companies (“Accord”) (TSX: ACD) announced the hiring of Michael Wun as VP, IT. In this role, he will raise the bar for both clients and employees by implementing leading-edge technology for greater efficiency across Accord’s suite of tailored financial solutions.

Accord Financial Corp. (TSX – ACD) today released its financial results for the fourth quarter and year ended December 31, 2021. The financial figures presented in this release are reported in Canadian dollars and have been prepared in accordance with International Financial Reporting Standards.

Companies need flexible financing options to meet their cash flow needs, because there’s no telling when exciting growth opportunities will present themselves.

While the Business Credit Availability Program (BCAP) Guarantee officially ended on December 31st 2021, Accord Financial and Export Development Canada (EDC) understand that there are still challenges brought on by the pandemic such as supply chain issues, labor shortages and, most recently, high inflation.

Accord Financial Corp. (“Accord”) today announced the relaunch of AccordExpress, Accord’s unique small business financing program. For 2022, AccordExpress is tailored to support companies engaged all the way along the export supply chain. Direct exporters, as well as indirect exporters (companies supporting exporters with goods and services), are invited to apply.

Accord Financial Corp. (TSX – ACD) today announced that its Board of Directors has declared a quarterly dividend of $0.075 per common share, payable March 1, 2022, to shareholders of record at the close of business February 15, 2022. This represents a 50 percent increase from $0.05 per share paid in recent quarters.

Accord Financial Corp., one of the U.S. and Canada’s leading independent finance companies (“Accord”) (TSX: ACD) announced the hiring of Todd Eubanks as SVP, Underwriting and Portfolio Risk. As a member of the Executive Leadership team, he will be responsible for setting the direction of the company’s credit risk functions, culture and policies, helping to advance Accord’s credit strategy and the processes and controls designed to mitigate risks within the loan portfolio.

Bridge financing or bridge loans are aptly named because they “bridge the gap” between an unexpected event and a long-term financing solution to prevent a cash crunch. While bridge financing is often used in real estate transactions for homeowners, businesses can benefit from it as well.

Accord Financial Corp., one of the U.S. and Canada’s leading independent finance companies (“Accord”) (TSX: ACD) announced the appointment of Jim Hogan as President, U.S. Asset Based Lending (ABL) as of January 1, 2022.

Accord Financial Corp., one of the U.S. and Canada’s leading independent finance companies (“Accord”) (TSX: ACD) announced the closing of its first private securitization facility agented by a Fortune 500, A.M. Best A+ rated Canadian life insurance company.

Accord Financial is pleased to announce that it closed a $15M facility for an oil and gas services company. Our newest client provides transportation, environmental and related services to the Oil and Gas sector.

Accord Financial Corp. (TSX: ACD) today released its financial results for the three and nine months ended September 30, 2021. The financial figures presented in this release are reported in Canadian dollars and have been prepared in accordance with International Financial Reporting Standards.

Accord’s Capital Markets group was created to fund lending opportunities in a collaborative manner with other financing companies, enabling us to meet the larger needs of customers. Today, we are announcing Mike Wells will take on the responsibilities of Director, Capital Markets.

Accord Financial Corp. (TSX – ACD) today announced that its Board of Directors has declared a quarterly dividend of $0.05 per share, payable December 1, 2021, to shareholders of record at the close of business November 15, 2021.

Mid-market companies across the globe are currently constrained by supply chain difficulties. But what happens when growth is hindered by liquidity, labor or capacity?

“We’re in the first inning” proclaimed Calix Networks’ Chairman & CEO Carl Russo about the current period of robust activity within the communications space in response to a question posed to a panel assembled at Rural Broadband Symposium 2021.

A company can be profitable but still find themselves in a cash crunch when outstanding invoices have not been paid. If the balance sheet isn’t strong enough for conventional financing, you should consider factoring.

Sign Up now for Rural Broadband Forum 2021. There is a lack of broadband and rural networks combined with an explosion in businesses and opportunities. Join our incredible list of panelists at this live webinar on Tuesday, September 28th at 1 PM EST.

Accord Financial Corp. (TSX – ACD) today released its financial results for the three and six months ended June 30, 2021. The financial figures presented in this release are reported in Canadian dollars and have been prepared in accordance with International Financial Reporting Standards.

Accord Financial Corp. (TSX – ACD) today announced that its Board of Directors has declared a quarterly dividend of $0.05 per share, payable September 1, 2021, to shareholders of record at the close of business August 16, 2021.

Alternative financing can be beneficial for businesses of all sizes, offer many advantages and is cost-effective. With asset-based loans and other financing solutions, alternative lenders effectively fill in financing gaps for businesses and entrepreneurs.

Cash flow is a common problem in the transportation industry. The pain point for most transport businesses arises from the mismatch between the cash payments received from customers and the cash payments they have to make for operating expense, especially fuel and labor.

Accord Financial Corp. announces Canada’s fastest, most flexible factoring solution for entrepreneurs.

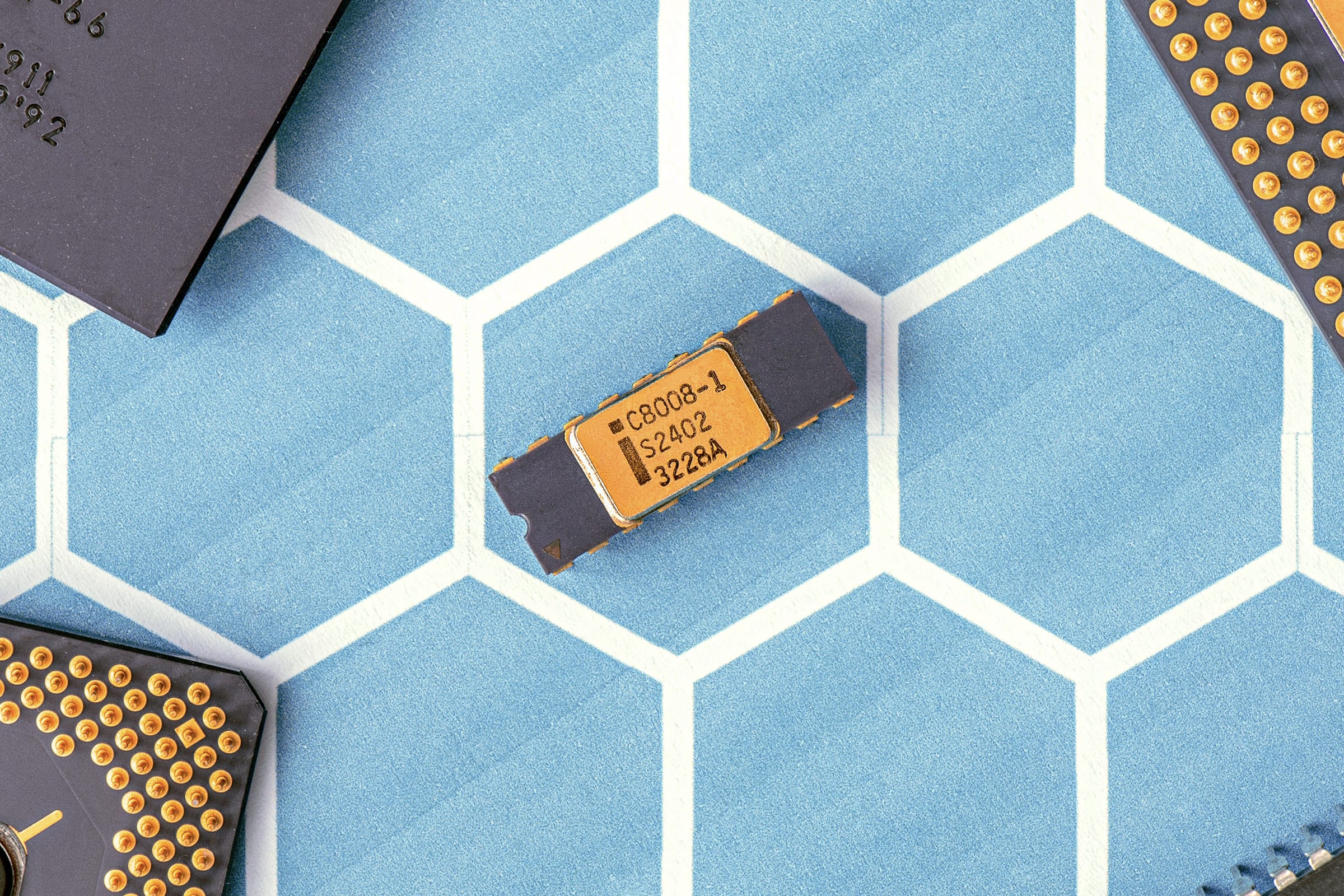

Transformation is increasingly less of a choice in financial services. As companies embrace digital technologies, the process is often easier said than done. Accord has been on a digital transformation journey for the past three years. In a recent article in Information Week, Eric Starr, Accord’s SVP, Program Operations and Risk, shares tips learned through this process.

Accord’s Capital Markets group was created to fund lending opportunities in a collaborative manner with other financing companies, enabling us to meet the larger needs of customers.

Accord Financial Corp. (TSX – ACD) (the “Company”) today announced the voting results from its Annual and Special Meeting of Shareholders (“ASM”) held on May 5, 2021 in Toronto, Ontario.

Meridian and Accord Financial Corp. announced a strategic partnership today to provide small and medium businesses with more options for financing. It comes at a time when businesses are looking for ways to ensure they succeed today and be positioned for the post-pandemic future.

Accord Financial Corp. (TSX – ACD) today released its financial results for the quarter ended March 31, 2021. The financial figures presented in this release are reported in Canadian dollars and have been prepared in accordance with International Financial Reporting Standards.

Accord Financial Corp. (TSX – ACD) today announced that its Board of Directors has declared a quarterly dividend of $0.05 per share, payable June 1, 2021, to shareholders of record at the close of business May 14, 2021.

Although much of the sporting goods sold in North America are imported from overseas, there has been an increase in reshoring for many categories. Working capital needs differ greatly between domestic production and importing to get from design to collecting accounts receivable post-sale in the cash conversion cycle.

Fiscal 2020 presented Accord’s toughest challenge since the start-up years in the late 1970s. Despite the headwinds we made significant progress in positioning Accord for the next phase of growth. As the economy reopens, Accord is ready to roll.

When business owners reach out to discuss their working capital requirements, many have a need relating to purchase order financing, or PO financing. In the simplest form, they have an order or pipeline of orders, but lack the cash flow to be able to convert their orders into sales.

With consumer spending patterns shifting from services to goods, U.S. manufacturing has benefited from onshoring during the pandemic. Clogged international logistics channels from foreign goods manufacturers combined with national support for job creation…

Accord Financial Corp. (TSX – ACD) today released its financial results for the fourth quarter and year ended December 31, 2020. The financial figures presented in this release are reported in Canadian dollars and have been prepared in accordance with International Financial Reporting Standards.

Factoring is the purchase of a company’s receivables where the factor advances 75-90% of the face value of the invoices once the product or service is delivered to the customer. It’s like a real-time line of credit in terms of cash flow. The reserve, the 10-25% is given to the company when their customer pays the invoice.

Accord Financial Corp. (TSX – ACD) today announced that its Board of Directors has declared a quarterly dividend of $0.05 per share, payable March 1, 2021, to shareholders of record at the close of business February 15, 2021.

Fincura, Inc. expands relationship with Accord Financial Corp., providing its AI and machine learning capabilities to significantly enhance the richness of data collected by Accord, enabling insight, service, support and knowledge few lenders can rival.

While the US and Canada continue to rank high in the aerospace industry, a lot of focus is currently being centered on sustaining liquidity and re-strategizing for growth, both now and in the nearest future.

Accord Financial today announced the launch of AccordExpress, a financing solution aimed at bridging Canadian small businesses through to the economic recovery.

Barrett Carlson and Eric Starr Promoted to Executive Leadership Positions

Corporate finance strategies involving mergers and acquisitions, buyouts, take-overs, distressed mergers and acquisitions, etc., can be very extensive and need substantial financing.

As food businesses focus on continued operations and growth, one thing remains certain — cash is king. Regardless of the food product or service provided, your food business relies heavily on cash to meet a higher scale of demand and operations.

A suitable and reliable financing partner is one that is flexible, understands your business and is…

Investments in information and technology also constitute a major portion of overall expenditure for service businesses….

Manufacturing businesses rely substantially on heavy machinery and equipment, the acquisition and maintenance for which make…

Accord Financial Corp. (TSX – ACD) today released its financial results for the three and nine months…

Simplifying access to capital for small and medium businesses across the U.S. and Canada is the…

Equipment costs make up a substantial amount of total capital expense incurred by capital intensive businesses…

Many businesses focus on measuring key performance indicators centered around sales but pay less attention to…

Inadequate access to capital poses one of the most daunting challenges for businesses. Lending companies seeking…

Business growth can be reflected in many areas, some of which include: sales growth, increase in…

At any given stage of operations, your business needs funds to thrive. Shortage of funds can…

Accord Financial Corp. (TSX: ACD) today released its financial results for the three and six months…

Running a business on credit terms comes with its inherent challenges. Many businesses face bankruptcy and…

Accord Financial Corp. (TSX – ACD) (“Accord Financial”) today announced the launch of its participation in the…

With high competition comes the need to attract and retain customers, thus, most businesses operate on…

One of the major objectives of every business is to be profitable. On the forefront of…

The survival of a business is highly dependent on sufficient cash flow for operations, capital expenditures…

Accord Financial Corp. (TSX – ACD) today released its financial results for the quarter ended March 31…

Accord Financial Corp. (TSX – ACD) (the “Company”) today announced that the Company will delay the filing…

Asset-based loans interest rates can vary based on the source of procurement of the loans…

Accord Financial Corp. (TSX – ACD) (the “Company”) today announced the voting results from its Annual General…

Accord Financial Corp. (TSX – ACD) (“Accord” or the “Company”) today announced that its Board of Directors…

Business succession planning is not a contingency plan, it is a core human resources function that…

Growing your business is essential and requires capital. Whether you are seeking to expand your mid-size…

As a business owner or advisor, you know that it’s pretty common to experience ebbs and flows…

Many thriving businesses were launched from one small idea that grew, flourished and established a significant…

After successfully completing a five-year transformation into a streamlined commercial finance powerhouse, we took the opportunity…

We’ve been through many economic cycles, but none that descended so quickly into near shutdown of…

Net loss attributable to the Company’s shareholders was $5,876,000 for the first quarter of 2020 compared…

Accord Financial Corp. (TSX – ACD) today released its financial results for the fourth quarter and year…

Accord Financial Corp. (TSX – ACD) today announced that its Board of Directors has declared a quarterly…

Asset-based lending provides working capital in order to facilitate expansion, replace an existing credit line, weather seasonable gaps, and/or support a turnaround.

Cyber security is the most important business risk for the second year in a row according…

Many organizations subscribe to a “just the facts” structure for their investor presentation. They spout statistic…

Stories engage our lives. We attend movies and plays, we read novels, we watch TV, and…

From origination to funding all in a millisecond. According to Andrew Yang, American entrepreneur, the founder…

The demand for more in-depth, detailed knowledge to make more intelligent decisions faster and efficiently has…

Easy Business Financing to Grow Your Company or Transition to SuccessIf your business is growing, you…

We just closed the books on our strongest year since founding in 1978. Total funds employed…

Access to capital is the engine that drives the business economy. Without capital, entrepreneurs and owners…

At a recent Fintech Conference in NYC, I listened to many pundits speak about the future…